by | Feb 11, 2021 | Tax Tips and News

It won’t be long before the Internal Revenue Service opens its gates and the filing season will be officially underway.

In the meantime, though, there’s enough work to keep us all busy. That starts with taxpayers, who, if they haven’t done so already, should be gathering their records now. This includes all year-end income documents they have to help ensure they can file a complete and accurate 2020 income tax return and avoid refund delays.

The necessary records include W-2s, 1099s, receipts, canceled checks and any other documents supporting any income, deductions or credits on their return.

Many of the reporting forms should have already been received by taxpayers. These forms include:

- Forms W-2, Wage and Tax Statement

- Form 1099-MISC, Miscellaneous Income

- Form 1099-INT, Interest Income

- Form 1099-NEC, Non-employee Compensation

- Form 1099-G, Certain Government Payments; such as unemployment compensation or a state tax refund

- Form 1095-A, Health Insurance Marketplace Statements

Other steps to take now

It’s a good idea for taxpayers to look at their IRS account online before starting their own filing process, whether doing it themselves or using a tax professional.

This allows them to see the latest information about their federal tax account and most-recently filed tax return using a secure and convenient tool on IRS.gov. It’s especially handy if they need information from last year’s return.

Those with an account on IRS.gov can also see the amounts of any Economic Impact Payments the taxpayer has received. This can be helpful to eligible taxpayers who either did not receive any Economic Impact Payments – or got less than the full payments. They can then claim the recovery rebate credit on their 2020 federal tax return.

People can visit Secure Access: How to Register for Certain Online Self-Help Tools for more information about how to create an account or how to reset the username or password.

Don’t overlook unemployment benefits

We can’t stress this point enough: Unemployment compensation is taxable and must be included as gross income on a taxpayer’s return. As we mentioned, taxpayers should have already received a Form 1099-G, showing their unemployment income.

People can have federal taxes withheld from their unemployment benefits or make quarterly estimated tax payments, but a surprising number of taxpayers don’t do either one. In that case, taxes on those benefits must be paid when their 2020 tax return is filed. So those who didn’t have tax withheld from their unemployment payments could see a smaller refund than expected or could possibly even have a tax bill due.

Taxpayers who get a Form 1099-G for unemployment compensation they never received should contact their state tax agency and ask for a corrected Form 1099-G.

However, taxpayers should file an accurate return that includes the income they actually received.

States shouldn’t issue Forms 1099-G to taxpayers they know to be victims of identity theft involving unemployment compensation. Taxpayers who are victims of unemployment compensation-based identity theft should not file an identity theft affidavit with the IRS.

For more information, check out Tax Topic 418, Unemployment Compensation; Publication 525, Taxable and Nontaxable Income; and What Taxpayers Need to Know to Claim the Earned Income Tax Credit.

Source: COVID Tax Tip 2021-16

– Story provided by TaxingSubjects.com

by | Feb 10, 2021 | Tax Tips and News

Taxpayers may be aware that the Families First Coronavirus Response Act (FFCRA) includes a refundable tax credit for eligible employers who provide COVID-related sick and family leave. What some might not know is that this credit is also available for self-employed individuals, and a new form from the Internal Revenue Service makes claiming it straightforward.

What form should self-employed individuals use to claim FFCRA sick leave and family leave tax credits?

The IRS this week announced that Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals, is now available for download on IRS.gov. In addition to completing Form 7202, the agency notes that eligible self-employed individuals will need to make sure they claim the credit on the appropriate Form 1040:

- 2020 Form 1040 for leave taken between April 1, 2020, and December 31, 2020

- 2021 Form 1040 for leave taken between January 1, 2021, and March 31, 2021

When calculating the amount of the sick leave or family leave tax credit, the IRS suggests checking out sections 61 and 63 under “Special Issues for Employees” on IRS.gov.

Which self-employed individuals can claim the FFCRA sick and family leave tax credit?

The IRS says that self-employed individuals must have documentation showing that COVID-19 caused them to be “unable to work or telework for reasons relating to their own health or to care for a family member.” And the Department of Labor lists these six reasons that employees, in general, can qualify for FFCRA paid sick leave:

- is subject to a Federal, State, or local quarantine or isolation order related to COVID-19;

- has been advised by a health care provider to self-quarantine related to COVID-19;

- is experiencing COVID-19 symptoms and is seeking a medical diagnosis;

- is caring for an individual subject to an order described in (1) or self-quarantine as described in (2);

- is caring for a child whose school or place of care is closed (or child care provider is unavailable) for reasons related to COVID-19; or

- is experiencing any other substantially-similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury.

Self-employed individuals will also need to confirm that their trade or business “qualifies as self-employment income” and that they are “eligible to receive qualified sick or family leave wages under the Emergency Paid Sick Leave Act as if [they were] an employee.”

For more information about Form 7202 and other coronavirus tax relief, check out these IRS resources:

Source: IR-2021-31

– Story provided by TaxingSubjects.com

by | Feb 8, 2021 | Tax Tips and News

The Internal Revenue Service is reminding taxpayers that the best tax professionals are those who always sign the returns they’ve prepared. These so-called “ghost preparers” refuse to sign the returns they prepare—whether physically or digitally—getting the taxpayer to sign the return while the preparer remains anonymous.

The IRS notes that, regardless of who prepares the return, taxpayers are “ultimately responsible for [the accuracy of their tax return].” In addition to possible issues with accuracy, these ghost preparers can present an identity theft and tax refund fraud risk.

It’s the law

By law, anyone who is paid to prepare—or assists in preparing—federal tax returns must have a valid Preparer Tax Identification Number, or PTIN. Paid preparers must sign and include their PTIN on the return.

Not signing a return could be a red flag of questionable behavior, including promises of a big refund and charging fees based on the size of the taxpayer’s refund.

The IRS says taxpayers should also avoid using tax preparers who:

- Require payment in cash only and do not provide a receipt.

- Invent income to qualify their clients for tax credits.

- Claim fake deductions to boost the size of the refund.

- Direct refunds into their bank account, not the taxpayer’s account.

Homework pays off

The IRS urges taxpayers to choose their tax professional wisely. The Choosing a Tax Professional page on IRS.gov has information about tax preparer credentials and qualifications.

The IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications can help identify many preparers by the type of their credentials or qualifications.

No matter who prepares the return, the IRS says taxpayers should review it carefully and ask questions about anything that’s not clear before signing. They should also verify both their routing and bank account numbers on the completed return with a direct deposit refund.

Taxpayers should also watch out for preparers who put their own bank account information onto their return instead of the taxpayer’s.

Source: IR-2021-30

– Story provided by TaxingSubjects.com

by | Feb 6, 2021 | Tax Tips and News

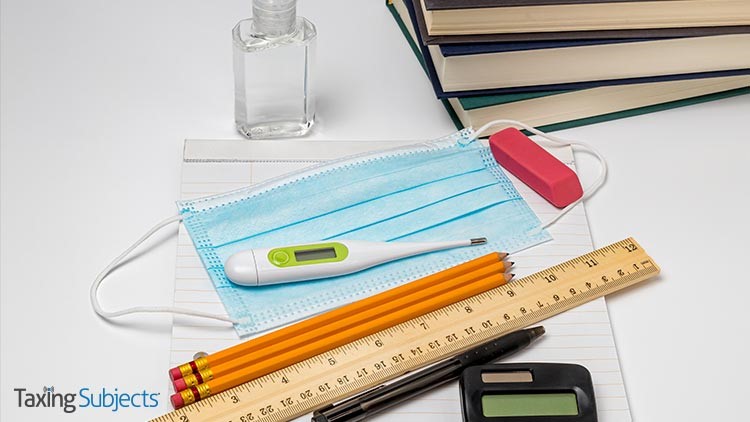

Since the coronavirus pandemic began, we’ve heard a lot about front-line health care workers and their risks. Now, we’ve come to know that teachers face risks of their own.

To help mitigate those risks, eligible educators can now deduct their unreimbursed expenses for personal protective equipment (PPE) to help stop the spread of the virus in the classroom.

Rev. Proc. 2021-15 provides guidance for educators on their expenses under the COVID-related Tax Relief Act of 2020, enacted as part of the Consolidated Appropriations Act, 2021.

The new law clarifies that unreimbursed expenses paid or incurred after March 12, 2020, by eligible educators for protective items to stop the spread of COVID-19 qualify for the educator expense deduction.

Covered COVID-19 protective items include, but are not limited to:

- face masks;

- disinfectant for use against COVID-19;

- hand soap;

- hand sanitizer;

- disposable gloves;

- tape, paint or chalk to guide social distancing;

- physical barriers (for example, clear plexiglass);

- air purifiers; and

- other items recommended by the Centers for Disease Control and Prevention (CDC) to be used for the prevention of the spread of COVID-19.

Educator expense deduction rules permit eligible educators to deduct up to $250 of their qualified expenses per year. The deduction rises to $500 if both spouses are eligible educators and they file married filing jointly. In either case, the deduction is limited to $250 each.

Eligible educators include anyone who is a kindergarten through grade-12 teacher, instructor, counselor, principal or aide in a school for at least 900 hours during a school year.

This deduction is for expenses paid or incurred during the tax year. Taxpayers can claim the deduction on Form 1040, Form 1040-SR, or Form 1040-NR (attach Schedule 1 (Form 1040).

For more information on the deduction for expenses of an eligible educator, see the Instructions for Form 1040 and Form 1040-SR, or the Instructions for Form 1040-NR.

Details on this provision, the Tax Relief Act of 2020 and other tax changes can be found on the IRS website, IRS.gov.

– Story provided by TaxingSubjects.com

by | Feb 4, 2021 | Tax Tips and News

Thanks to recent legislation, U.S. corporations can deduct up to 100% of their contributions to relief effort for a qualified disaster. They are also getting a break on how they have to document it.

The Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA) temporarily increased the limit for corporate contributions paid in cash for relief efforts in qualified disaster areas—up to 100% of a corporation’s taxable income.

What qualifies?

The new law specifies qualified disaster areas are those where a major disaster has been declared under section 401 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act.

It should be noted that any disaster declaration relating to COVID-19 is not covered.

Otherwise, it includes any major disaster declaration made by the President between Jan. 1, 2020, and Feb. 25, 2021, as long as it is for an event specified by the Federal Emergency Management Agency as beginning after Dec. 27, 2019, and no later than Dec. 27, 2020.

FEMA.gov has a list of disaster declarations.

To qualify, contributions must be paid by the corporation in the period beginning Jan. 1, 2020, and ending Feb. 25, 2021. Cash contributions to most charitable organizations qualify for the increased deduction limit. However, contributions made to a supporting organization or to establish or maintain a donor-advised fund do not.

Doing the math

A corporation chooses to take advantage of the increased limit by calculating its deductible amount of qualified contributions using the increased limit and claiming the amount on a tax return for the tax year the contribution was made.

Usual record-keeping steps apply to the deduction. Qualifying corporations have to obtain a contemporaneous written acknowledgment (CWA) from the charity. The corporation has to get its CWA before filing its return; but it has to be obtained no later than the return’s due date—including extensions.

The TCDTRA of 2020 added a new twist to this process with a new requirement.

Corporations taking advantage of the increased limit have to include a disaster relief statement to their CWA. The statement should state that the contribution was used—or is to be used—by the eligible charity for relief efforts in one or more qualified disaster areas.

Because the new requirement came along in late 2020, the IRS says it recognizes that some corporations may have gotten a CWA that lacks a disaster relief statement.

Therefore the IRS won’t challenge a corporation’s deduction of any qualified contribution made before Feb. 1, 2021, solely on the grounds that the corporation’s CWA doesn’t include a disaster relief statement.

For more information on documenting gifts to charity, see Publication 526, Charitable Contributions, available on IRS.gov.

Source: IR-2021-27

– Story provided by TaxingSubjects.com